SCED calculates Locational Marginal Prices (LMPs) using a two-step methodology that applies mitigation to resolve non-competitive constraints. Real-Time Prices Displays Real-Time LMPs for Latest SCED Run Display View the Locational Marginal Prices per Settlement Point from the real-time market for the latest SCED run which is normally within.

SPP's relationships with our members – some of which stretch back decades – are very important to us. Members drive our major decisions and future plans; we work together to ensure the region enjoys a reliable electric supply and economic well-being. SPP's collaborative and evolutionary approach resulted in the successful 2007 implementation of the real-time EIS (Energy Imbalance Service) Market. The EIS Market beat expectations in its first year, with a benefit to the footprint of $103 million – $17 million above initial estimates.

Integrated Marketplace

SPP began developing new energy markets in 2009 to bring additional regional benefit to our members. The Integrated Marketplace launched in 2014 – making SPP the first RTO to design, build and implement a Day 2 market on time – and includes a Day-Ahead Market with Transmission Congestion Rights, a Reliability Unit Commitment process, a Real-Time Balancing Market replacing the EIS Market and the incorporation of price-based Operating Reserve procurement. The Integrated Marketplace also consolidated the SPP footprint's 16 legacy Balancing Authorities into an SPP Balancing Authority.

NOTE: All Integrated Marketplace market data can be found on the Marketplace Portal.

Market Monitoring

The Market Monitoring page contains a description of the Market Monitoring responsibilities and periodic reports. The page also includes instructions on submitting a request for inquiry.

Market Prices

- Locational Marginal Pricing. PJM uses locational marginal pricing to set prices for energy purchases and sales in the PJM market and to price transmission congestion costs. Congestion is when the lowest-priced energy is prevented from flowing freely to a specific area on the grid because heavy electricity use is causing parts of the grid to operate near their limits.

- This pricing, also known as Locational Marginal Pricing, or LMP, is newly explained in an updated fact sheet at pjm.com. A global standard for energy markets and operations, LMP was introduced at PJM in 1998. The concept pioneered a new way of accurately reflecting the cost of making and delivering electricity in real time.

- Distribution Locational Marginal Pricing (DLMP) for Congestion Management and Voltage Support Abstract: In this paper, a day-ahead market-clearing model for smart distribution systems is proposed. Various types of distributed energy resources (DERs), such as distributed energy storage, distributed generators, microgrids, and load aggregators.

Locational Marginal Price (LMP) is the market-clearing price for energy at a given Price Node equivalent to the marginal cost of serving demand at the Price Node, while meeting SPP Operating Reserve requirements. It is calculated using a Security Constrained Economic Dispatch (SCED) and is the price to provide the least-cost incremental unit of energy at a specific location, while also considering congestion and losses.

Caiso Locational Marginal Price

Market-Related Organizational Groups

Change Working Group

Market Working Group

Market and Operations Policy Committee

Settlement User Group

Oasis Node

Go to SPP's Oasis Node to request transmission service, obtain real-time transmission system information and learn more about SPP's business practices and tariff.

OPS1 Secure Portal

The OPS1 Secure Portal is a site used for transfer of data and information between SPP's members and SPP staff. Contained here are near real-time reliability and market reports, technical applications for submitting data to SPP and other system information.

Outage Coordination

SPP's Outage Coordination page contains information about and links to SPP's transmission and generation outage scheduling system.

Power Contracts Bulletin Board

The Power Contracts Bulletin Board facilitates power contracting activity for a large pool of buyers and sellers of contracts for electric power. The application is sponsored by the ISO/RTO Council, of which SPP is a member.

PrintLocational Marginal Pricing

Unlike petroleum pipelines or natural gas pipelines, which in most cases require compression to maintain sufficient pressure to move product from the wellhead to the sales point, the cost of moving additional electrons through a network of conductors is essentially zero, since there is no fuel cost for “compression” in electrical networks.

(Actually, this isn’t quite true for a couple of reasons. First, transmission lines aren’t perfect conductors, so there is some resistance in the network. Because of this resistance, some of the electricity injected into the transmission grid by power generators is lost as heat between the power plant and the customer. The magnitude of these “resistive losses” is around 10% in a modern power grid like North America’s. What this means is that the system has to generate more power than is actually demanded, to account for these losses. For example, if demand in a system with 10% losses is 100 MW, then the system will need to generate around 111 MW. Second, the transmission grid needs to maintain a certain voltage level, and maintaining this level sometimes involves output adjustments at the power plant location, which does impose an economic cost on the system. In the discussion here, we will ignore these two costs to focus on the effects of transmission congestion.)

Locational Marginal Price Of Energy

In the market-clearing example that we just went through, all suppliers were paid the market-clearing “system marginal price,” and the problem did not really say anything about where the generators or customers were located, or what the transmission network looked like. We just assumed that power produced at any one plant could be delivered to a customer at any location in the transmission network. Thus, electricity markets should exhibit the law of one price, just as we saw in natural gas networks.

While electricity markets should exhibit the law of one price, the reality is that they often do not. Figure 6.8 shows a contour map of electricity prices in the PJM electricity grid on a warm, but not terribly hot day in June 2005. You can find more up-to-date maps on the PJM website. You can also find a really nifty animation of LMPs from the MISO market. If you look carefully at the MISO animation, you may see some negative prices, meaning that someone using electricity gets paid to use it, and someone producing electricity actually pays to generate power! While this may seem strange, it is actually a natural economic outcome of a market with fluctuating supply and demand, and no storage. We'll get to the negative-price phenomenon later in the course.

Getting back to our picture of prices in the PJM system, you can see that prices in the western portion of PJM’s grid are an order of magnitude lower than prices in the eastern portion of the grid. This means that a power plant located in, say, Pittsburgh could make a lot of money by selling electricity to customers in Washington, DC. The demand from Washington should bid up the price in Pittsburgh as more generation in Pittsburgh comes online to serve the Washington market. This is just what we saw in our study of natural gas markets. But this doesn’t happen in electricity. Why?

The basic answer is “transmission congestion.” Conductors cannot hold an infinite number of electrons. At some point the resistive heat would just cause the conductor to melt. (Remember that materials expand when they get hot. When you hear about power lines “sagging” into trees, that is what’s going on.) So, power system engineers place limits on the amount of power that a transmission line can carry at any point in time. When a line’s loading hits its rated capacity, we say that the line is “congested” and it can’t transfer any additional power. So, the system has to find another way to meet demand, without additionally loading congested lines. Usually this involves reducing output at low-cost generators and increasing output at higher-cost generators. This process, known as “out of merit dispatch,” imposes an economic cost on the system.

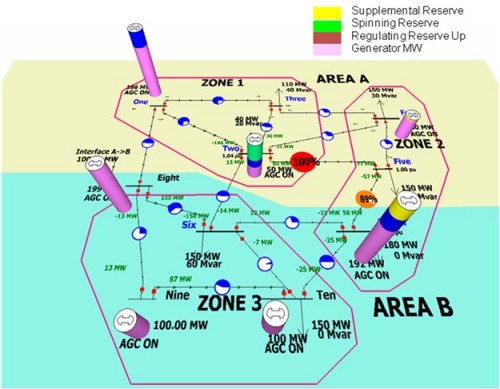

After correcting for transmission congestion by adjusting the dispatch of power plants, the cost of meeting demand in one location (e.g., Washington) may be substantially higher than the cost of meeting demand in another location (e.g., Pittsburgh). The locational marginal price (LMP) at some particular point in the grid measures the marginal cost of delivering an additional unit of electric energy (i.e., a marginal MWh) to that location.

We will illustrate the concept of LMP using the two-node network shown in Figure 6.9. Node 1 has 100 MWh of demand, while node 2 has 800 MWh of demand. There are two generators in the system – one at node 1 with a marginal cost of $20/MWh and one at node 2 with a marginal cost of $40/MWh. A transmission line connects the two nodes. For the purposes of this example, assume that either of the generators could produce 1,000 MWh, and we will ignore any issues with transmission losses. Both generators submit supply offers to the electricity market that are equal to their marginal costs.

Suppose that the transmission line could carry an infinite amount of electricity. How should the system operator dispatch the generators to meet demand? Either generator by itself could meet all 900 MWh of demand in the system, so the system operator would dispatch generator 1 at 900 MWh and generator 2 would not be dispatched. The SMP would be equal to $20/MWh.

Now, suppose that the transmission line could carry only 500 MWh. In this case, the system operator could supply all of the demand at node 1 with generator 1, but only 500 MWh of demand at node 2 with generator 1. The remaining demand at node 2 would need to be met by dispatching generator 2. Since there is plenty of generation capacity left at generator 1, if demand at node 1 were to increase by 1 MWh, it could be met using generator 1 and thus the LMP at node 1 is $20 per MWh. If demand at node 2 were to increase, that demand would need to be met by increasing output at generator 2. Thus, the LMP at node 2 would be $40 per MWh.

Next we'll look at how much the Generators are paid and how much the Customers pay. Customers at Node 1 are charged $20 per MWh, while customers at Node 2 are charged $40 per MWh for all energy consumed. Generator 1 is paid $20 per MWh, while Generator 2 is paid $40 per MWh for all energy produced. You may notice here that while customers at Node 2 pay $40 per MWh for all 800 MWh that they consume, some of that energy was imported from Node 1 at a much lower cost. This is not a mistake - it's how the LMP pricing system works in the US.

The RTO collects revenue from the customers as follows:

From Node 1: 100 MWh × $20 per MWh = $2,000

From Node 2: 800 MWh × $40 per MWh = $32,000

Total Collections = $34,000

The RTO pays the generators as follows:

To Node 1: 600 MWh × $20 per MWh = $12,000

From Node 2: 300 MWh × $40 per MWh = $12,000

Locational Marginal Pricing

Total Collections = $24,000

The RTO collects excess revenue in the amount of $34,000 - $24,000 = $10,000. It collects this excess revenue because customers at Node 2 pay $40/MWh for all energy consumed, while some of those megawatt-hours only cost $20/MWh to produce.

This excess revenue is called 'congestion revenue.' In general, when there is congestion in the network and LMPs differ, then there will be some congestion revenue. We will discuss later in the course what the RTO does with this extra revenue. For now, just remember that whenever there is transmission congestion and LMPs at different nodes of the network aren't equal, the RTO will usually wind up with some congestion revenue.

Locational Marginal Pricing Definition

As an exercise for yourself, calculate the LMPs and congestion revenue under a second two-node example. Demand at Node 1 is 5 MWh, while demand at Node 2 is 10 MWh. The transmission line connecting Nodes 1 and 2 has a capacity of 5 MWh. The marginal cost of Generator 1 is $10/MWh while the marginal cost of Generator 2 is $15/MWh.

You should find that the LMP at Node 1 is $10/MWh; the LMP at Node 2 is $15/MWh; and that 5 MW of power is exported from Node 1 to Node 2 on the transmission line.

Locational Marginal Pricing Lmp

You should also find that congestion revenue is equal to $25.